Understanding PIP Coverage: Your Complete Guide to Personal Injury Protection

Introduction

Welcome to the wild world of PIP coverage, where understanding your personal injury protection is as crucial as knowing the difference between a left and right turn signal! Whether you’re a seasoned driver or a new road warrior, navigating the ins and outs of PIP insurance can feel like trying to read a map in a foreign language. But fear not! We’re here to break it down into bite-sized, digestible pieces.

So, what exactly is PIP coverage? Think of it as your trusty sidekick in the chaotic adventure that is driving. Unlike traditional liability insurance, which protects you from claims made by others, PIP (or personal injury protection) swoops in to cover your own medical expenses when you find yourself in a car accident. It’s like having a safety net that catches you when you fall except this net also pays for your medical bills!

In this guide, we’ll explore everything from the basics of no-fault insurance to how to file a PIP claim without losing your mind. We’ll even delve into the nitty-gritty details like PIP deductible options and how state-specific laws can affect your coverage. So buckle up, because by the end of this ride, you’ll be well-equipped to tackle any questions about personal injury protection coverage.

Key Takeaway: Understanding PIP coverage isn’t just about knowing how it works; it’s about ensuring you’re protected on the road. Ready to dive deeper? Let’s hit the gas!

What is PIP Coverage?

So, let’s dive into the world of PIP coverage, shall we? Personal Injury Protection (PIP) is like your trusty sidekick in the realm of auto insurance, specifically designed to help you out when life throws you a curveball like a car accident. Think of it as your financial safety net that kicks in regardless of who’s at fault.

First things first: PIP is often referred to as no-fault insurance. This means that, unlike traditional liability insurance where you have to prove who’s guilty in the event of an accident, PIP coverage pays for your medical expenses and certain other costs right off the bat. No blame game here!

Now, why is this important? Well, if you’re ever involved in a car accident (knock on wood), PIP can cover:

- Your medical expenses related to injuries sustained in the accident

- Lost wages while you’re recovering

- Other necessary expenses that arise from the accident, like rehabilitation costs or even funeral expenses in tragic cases

In short, having personal injury protection coverage can be a lifesaver literally and figuratively! It ensures that you don’t have to struggle with mounting medical bills while you’re trying to heal. Plus, it can make navigating through the aftermath of an accident a whole lot smoother.

Key Takeaway: PIP coverage is essential for protecting yourself financially after an auto accident. It helps cover medical expenses and lost wages without needing to establish fault.

PIP Insurance Benefits

When it comes to PIP coverage, understanding the benefits can feel like trying to decipher a secret code. But fear not! We’re here to unlock the vault of knowledge on personal injury protection. So, grab your decoder ring, and let’s dive in!

- Medical Coverage Auto Insurance: PIP coverage is like having a superhero sidekick for your health expenses. Whether you need emergency care, hospital stays, or follow-up treatments after a car accident, PIP swoops in to save the day. It typically covers medical bills regardless of who was at fault.

- Car Accident Medical Coverage: Imagine this: you’re in a fender bender, and suddenly you’re facing hefty medical expenses. With PIP, those costs are covered up to your policy limits. This means less stress and more focus on recovery like a cozy blanket on a chilly night.

- PIP Benefits Explained: Think of PIP as your financial cushion during tough times. It often includes coverage for lost wages if you’re unable to work due to injuries sustained in an accident. You can think of it as your personal injury protection plan that helps keep your financial ship afloat while you heal.

- PIP vs Liability Insurance Comparison: Now, let’s clear up some confusion here. While liability insurance covers damages you cause to others (think of it as paying the bill when you accidentally break someone’s favorite mug), PIP covers your own injuries and medical expenses. It’s like choosing between being the hero or the one who needs saving both are important, but they serve different purposes!

Key Takeaway: Understanding PIP benefits is crucial for maximizing your personal injury protection coverage and ensuring you’re prepared for any unexpected medical expenses that come from an auto accident.

PIP Claim Process

Filing a claim for PIP coverage can feel like navigating a maze blindfolded, but fear not! We’re here to shine a light on the path to securing your personal injury protection benefits.

1. Filing a PIP Claim Steps

The first step in the PIP claim process is to report your car accident to your insurance company as soon as possible. Here’s how to get started:

- Gather Information: Collect all relevant details from the accident, including police reports and witness statements.

- Contact Your Insurer: Reach out to your auto insurance provider and inform them of the accident.

- Complete Necessary Forms: Fill out any required claim forms provided by your insurer.

- Submit Documentation: Send in all supporting documents, such as medical records and bills related to your injuries.

- Follow Up: Keep in touch with your insurer to track the progress of your claim.

2. PIP Deductible Options

Your PIP insurance policy may come with deductible options that can affect how much you’ll need to pay out-of-pocket before coverage kicks in. Here’s a quick breakdown:

- No Deductible: You pay nothing before benefits start flowing.

- Low Deductible: You might pay a small amount (like 0) before coverage begins, which can lower your premium costs.

- High Deductible: A higher deductible (like ,000) can significantly reduce your premium but will increase your out-of-pocket expenses after an accident.

3. Coordinating Benefits with PIP Coverage

If you have multiple insurance policies or other benefits available, coordinating those with your PIP coverage is essential. This means understanding how each policy interacts with one another. For example, if you have health insurance that covers some medical expenses from the accident, it might reduce what you can claim under PIP. Always read the fine print!

4. Pursuing Personal Injury Protection Claims Effectively

Pursuing personal injury protection claims effectively requires diligence and attention to detail. Here are some tips for maximizing your success:

- Document Everything: Keep meticulous records of all medical treatments and expenses related to the accident.

- Select Qualified Providers: Ensure that healthcare providers you visit understand how PIP claims work; they should be familiar with billing practices specific to car accidents.

- Avoid Common Pitfalls: Don’t delay in filing claims or submitting documentation time limits apply!

- If Denied, Don’t Give Up: If your claim is denied, review the reasons carefully and consider appealing or consulting an attorney for assistance.

PIP Insurance Policy Details

When it comes to PIP coverage, understanding the nitty-gritty of your policy is crucial. Think of it as the fine print that can make or break your experience when you need it the most. Let’s dive into the key details that every savvy driver should know!

Choosing the Right PIP Coverage Amount

First off, how much PIP coverage do you actually need? This isn’t just a wild guess; it’s about assessing your lifestyle, medical needs, and financial situation. Here are some factors to consider:

- Your health insurance coverage: If you have robust health insurance, you might opt for a lower PIP amount.

- Your driving habits: Frequent long-distance driving? You may want more coverage.

- Your financial situation: Consider how much medical expenses could impact your finances after an accident.

Understanding Personal Injury Protection Limits

PIP limits vary by state and policy. Most policies will outline a maximum amount they will pay for medical expenses, lost wages, and other costs. Be sure to:

- Check your state’s minimum requirements for PIP coverage.

- Understand what happens once you hit those limits will you be out of pocket?

- Consider adding additional coverage if you’re at risk of exceeding these limits.

PIP Premium Costs and Factors Affecting Them

The cost of your PIP insurance can fluctuate based on several factors. Here’s what typically influences those premium costs:

- Your age and driving history: Younger drivers or those with a checkered past may face higher premiums.

- Your location: Urban areas often see higher rates due to increased accident likelihood.

- Coverage amounts: The more coverage you want, the more you’ll likely pay.

Key Takeaway: Understanding your PIP insurance policy details is essential for maximizing benefits and ensuring you’re adequately covered in case of an accident. Don’t leave it to chance review your policy regularly!

State-Specific PIP Laws and Requirements

When it comes to PIP coverage, one size definitely does not fit all. Each state has its own unique set of laws and requirements governing personal injury protection, making it essential for drivers to understand the specific rules in their state. Think of it like a buffet everyone has their own plate, and what’s available varies based on location!

Overview of State-Specific PIP Laws

Most states fall into one of two categories: those that require PIP coverage as part of their no-fault insurance systems, and those that don’t. In states with mandatory PIP laws, drivers must carry a minimum amount of coverage to help cover medical expenses after an accident, regardless of who is at fault.

Personal Injury Protection Requirements by State

Here’s a quick rundown of how some states handle PIP:

- Florida: Requires ,000 in PIP coverage for medical expenses and lost wages.

- New York: Mandates ,000 in PIP coverage per person.

- Michigan: Offers unlimited medical benefits but varies on the required amounts based on the driver’s choice.

- Texas: Does not require PIP but offers it as an optional add-on to auto insurance policies.

The Impact of PIP on Premiums Across States

The cost of your auto insurance can be heavily influenced by the state you live in due to these varying laws. In states with higher required minimums for personal injury protection, you may find that your premiums are higher as well. It’s like paying for VIP access more coverage often means a bigger price tag!

Key Takeaway: Always check your state’s specific requirements for PIP coverage when shopping for auto insurance. This knowledge could save you money and ensure you’re adequately protected after an accident!

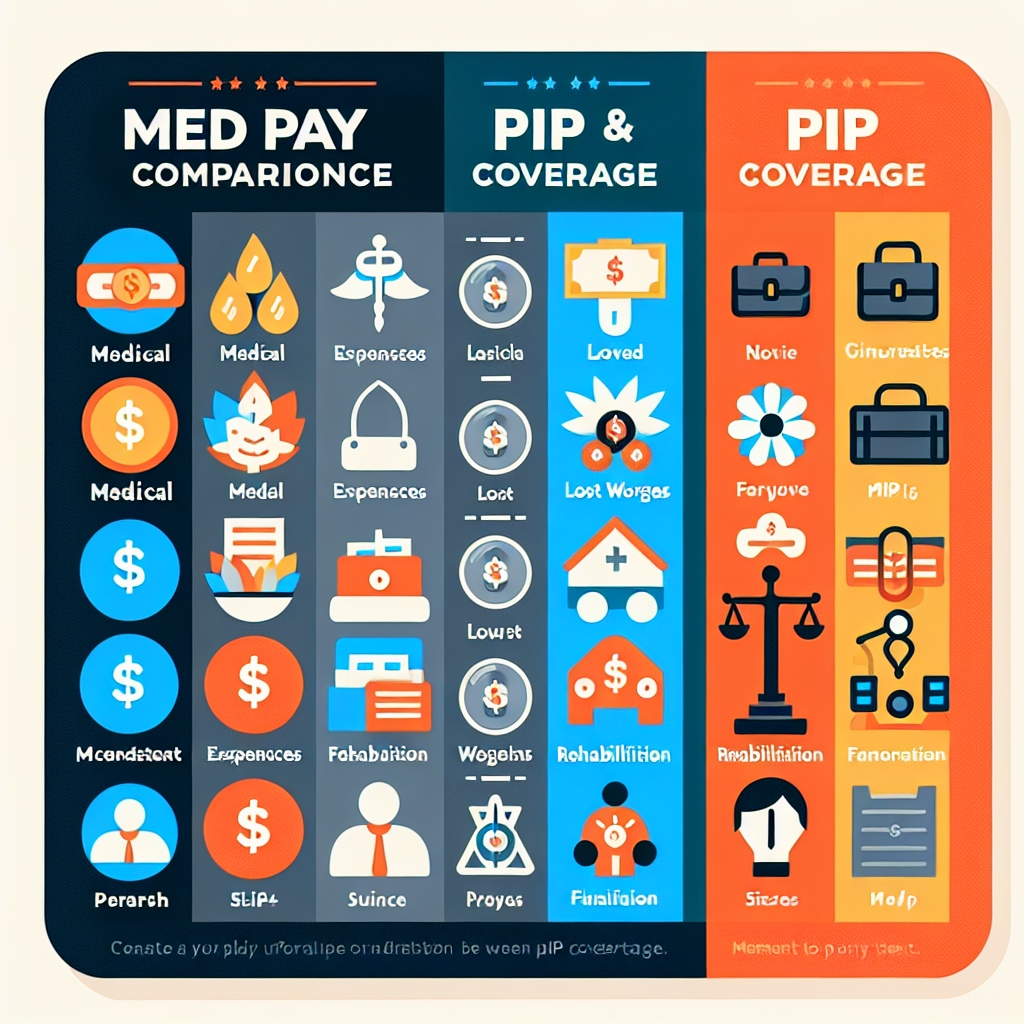

Differences Between Med Pay and PIP Coverage

When it comes to auto insurance, understanding the nuances between different types of coverage can feel like deciphering a secret code. Two terms that often pop up are Med Pay (Medical Payments) and PIP coverage (Personal Injury Protection). While they may seem similar, they have distinct features that can significantly impact your car accident medical coverage. Let’s break it down!

What is Med Pay?

Med Pay is like a trusty sidekick in your auto insurance policy. It covers medical expenses for you and your passengers, regardless of who was at fault in the accident. So, if you find yourself in a fender bender, Med Pay swoops in to save the day by covering:

- Emergency room visits

- Surgery costs

- X-rays and other diagnostic tests

- Ambulance rides

PIP Coverage Explained

PIP coverage, on the other hand, is like Med Pay’s more comprehensive cousin. It not only covers medical expenses but also includes additional benefits such as:

- Lost wages due to injury

- Rehabilitation costs

- Funeral expenses (in tragic cases)

- Household services if you’re unable to perform them due to your injuries

The Key Differences

| Med Pay | PIP Coverage | |

|---|---|---|

| Covers Medical Expenses? | Yes | Yes |

| Covers Lost Wages? | No | Yes |

| Covers Rehabilitation? | No | Yes |

| Covers Funeral Expenses? | No | Yes (under certain conditions) |

| No-Fault Insurance? | No (not always) | Yes (most states) |

Maximizing Your PIP Benefits

So, you’ve got your PIP coverage in place great! But how do you make sure you’re getting every last drop of goodness from those PIP insurance benefits? Think of it like a buffet; just because the food is there doesn’t mean you’ll get full if you don’t know what to pile on your plate!

Know Your Coverage Limits

First things first, understanding your personal injury protection limits is crucial. Each state has different personal injury protection requirements, and knowing what yours are can help you strategize. For instance, if your coverage is capped at ,000, and medical expenses start piling up after an accident, that could be a problem. Make sure to:

- Review your PIP policy details regularly.

- Ask your insurance agent about increasing limits if necessary.

- Understand any exclusions that might catch you off guard.

Document Everything

When it comes to filing a PIP claim, documentation is your best friend. If you were in a car accident, start collecting:

- Medical bills and treatment records.

- Accident reports from law enforcement.

- Any correspondence with your insurance company.

This documentation will not only support your claim but also speed up the process. Think of it as having a well-organized toolbox when tackling a DIY project you’ll get the job done much faster!

Pursue All Available Benefits

Your PIP coverage might include more than just medical expenses! Depending on your policy, you could also be eligible for:

- Lost wages if you’re unable to work due to injuries.

- Rehabilitation costs for physical therapy.

- Household services if you need help at home while recovering.

Selecting the Right Healthcare Providers

Your choice of healthcare providers can affect how smoothly the claims process goes. Make sure they understand how to coordinate benefits with PIP coverage. Some healthcare providers are more familiar with the intricacies of the PIP claim process than others. This can save time and hassle!

Avoid Common Pitfalls

You might think you’re covered for everything under the sun, but that’s not always true! Watch out for common misconceptions about personal injury protection claims:

- PIP covers all medical expenses: Not always! Check for exclusions related to pre-existing conditions or specific treatments.

- PIP claims are quick and easy: They can be delayed without proper documentation or understanding of state-specific laws.

- You can’t change providers during treatment: You absolutely can! Just ensure they accept PIP insurance.

The bottom line? Maximizing your PIP benefits requires vigilance and knowledge. By understanding your policy inside out and keeping meticulous records, you’ll be well on your way to ensuring that when life throws curveballs (like car accidents), you’re prepared to hit them out of the park!

PIP Exclusions and Limitations

PIP coverage is like the superhero of your auto insurance policy, swooping in to save the day when you’re injured in a car accident. But even superheroes have their weaknesses! Understanding the exclusions and limitations of PIP coverage is crucial to making sure you’re not left high and dry when you need help the most.

Common Exclusions

While PIP insurance benefits can be extensive, there are several common exclusions that could catch you off guard:

- Intentional Injuries: If you intentionally cause harm to yourself or others, don’t expect PIP to cover those medical expenses.

- Non-Motor Vehicle Accidents: Injuries from incidents that don’t involve a vehicle like slipping on a banana peel aren’t covered.

- Driving Under the Influence: If you’re caught driving under the influence of alcohol or drugs, your PIP claim may be denied.

- Passengers Without Coverage: If your passengers don’t have their own PIP coverage and are injured, they might not be able to claim benefits through your policy.

Limitations on Coverage Amounts

PIP coverage also comes with its fair share of limitations. Here’s what you need to know:

- Medical Expense Limits: Most states impose caps on how much PIP will pay for medical expenses. These limits can vary widely by state, so check your local laws!

- Time Limits for Claims: There’s often a ticking clock on how long you have to file a PIP claim after an accident. Miss this window, and you might miss out on benefits!

- Coverage for Lost Wages: While some PIP policies cover lost wages, there are usually caps on how much you can claim per week or month.

Tip: Always review your PIP insurance policy carefully! Knowing what’s excluded or limited can save you headaches down the road when filing personal injury protection claims.

PIP vs Liability Insurance

The differences between PIP and liability insurance can also impact your coverage. While liability insurance covers damages to others when you’re at fault, PIP is all about taking care of your own medical expenses regardless of fault. It’s like having two different shields: one protects others while the other protects YOU!

Avoiding Common Pitfalls

Avoiding pitfalls in understanding exclusions and limitations is key. Here are some strategies:

- Read Your Policy Thoroughly: Don’t just skim it; really dive into the details!

- Consult an Expert: If legal jargon makes your head spin, consider talking to an insurance agent or attorney who specializes in auto insurance.

- Create a Checklist: Make a list of what’s covered and what’s not so you can reference it easily if needed.

The bottom line? Understanding these exclusions and limitations will empower you to maximize your PIP benefits effectively. When life throws curveballs like car accidents you want to be prepared!

The Role of Healthcare Providers in PIP Claims

When it comes to navigating the choppy waters of PIP coverage, healthcare providers are your trusty lifeboat. They play a crucial role in the PIP claim process, ensuring that you receive the medical attention you need while also helping you maximize your PIP benefits. So, let’s dive into how these medical professionals can make or break your personal injury protection experience.

Understanding Your Medical Coverage

After a car accident, your first stop is often the doctor’s office. This is where healthcare providers document your injuries and start the treatment process. But here’s the kicker: they also provide essential documentation that supports your PIP claim. Without their input, filing a claim can feel like trying to assemble IKEA furniture without instructions frustrating and likely to end in disaster!

Documentation is Key

Your healthcare provider will create detailed medical records, including:

- Diagnosis: What injuries did you sustain?

- Treatment Plans: What kind of treatment will you need?

- Progress Notes: How are you recovering?

This documentation is vital not just for your health but also for proving your case when filing a PIP claim. Insurers want to see this information before they start cutting checks for those pesky medical expenses.

PIP Insurance Benefits and Healthcare Providers

Your healthcare provider can help you understand the full range of benefits available under your PIP insurance policy. This includes:

- Medical Expenses: Covers hospital bills, doctor visits, and rehabilitation.

- Lost Wages: If you’re unable to work due to injuries, they can help document that too!

- Household Services: Need someone to help with chores? They can assist in proving that need.

A Common Misconception: Med Pay vs PIP Coverage

A lot of folks get confused between Med Pay and PIP coverage. While both offer medical expense coverage after an accident, Med Pay often has limits that don’t cover lost wages or other non-medical expenses. Think of Med Pay as a snack-sized portion while PIP is a full-course meal satisfying but more comprehensive!

The Bottom Line

Your healthcare provider is more than just a person with a stethoscope; they’re an integral part of ensuring you get every bit of benefit from your PIP coverage. By effectively communicating with them and understanding their role in the claims process, you’ll be better prepared to tackle any challenges that come your way.

If you’ve been involved in an accident, make sure to keep those lines of communication open with your healthcare provider they’re on your side!

Conclusion

Understanding PIP coverage is like having a trusty umbrella on a rainy day it’s there to protect you when the unexpected happens. Whether you’re cruising down the highway or just parked at the grocery store, knowing your personal injury protection options can save you from a lot of headaches (and medical bills).

PIP insurance is not just another line item on your auto insurance policy; it’s your safety net. With benefits covering medical expenses, lost wages, and even rehabilitation costs, it ensures that you’re not left high and dry after a car accident. Remember, while no-fault insurance laws vary by state, having adequate personal injury protection can make a world of difference in your recovery journey.

As you navigate through the PIP claim process, keep in mind that being proactive about understanding personal injury protection requirements specific to your state can help you maximize your benefits. And let’s face it nobody wants to deal with complicated claims when they’re already dealing with the aftermath of an accident.

If you’re still unsure about how PIP works or if it’s right for you, consider reaching out to an insurance expert or legal professional who can provide personalized guidance tailored to your situation. After all, knowledge is power and in this case, it could be your ticket to peace of mind.